Download Nero 12 Platinum Full Version Terbaru 2013. Software yang populer dengan manfaat yang telah tidak diragukan lagi

masalah memburning cd/dvd. nero ini benar-benar sangat digemari oleh

umumnya orang. tetapi terasa kurang mantap bila nero kita pakai cuma

untuk urusan burning saja.

Saat ini ada dengan versi terbarunya, yakni Nero 12 Platinum HD Full Version Terbaru 2013. nero 12 ini ada dengan bermacam manfaatnya, dimulai dari mengedit lagu dengan nero waveeditor, mempercantik video dengan nero video, bila telah selesai pengeditannya tinggal diburning memakai nero burning rom atau nero express, sesudah selesai memburning ? waktunya mendesain cover cd/dvd nya memakai nero cover design. dengan nero 12 platinum hd ini anda tidak cuma dapat memburning cd/dvd tetapi dapat anda pakai untuk convert, ubah video, design cover, backup, dan seterusnya.

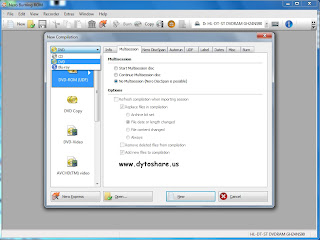

ScreenShot:

Persyaratan:

Saat ini ada dengan versi terbarunya, yakni Nero 12 Platinum HD Full Version Terbaru 2013. nero 12 ini ada dengan bermacam manfaatnya, dimulai dari mengedit lagu dengan nero waveeditor, mempercantik video dengan nero video, bila telah selesai pengeditannya tinggal diburning memakai nero burning rom atau nero express, sesudah selesai memburning ? waktunya mendesain cover cd/dvd nya memakai nero cover design. dengan nero 12 platinum hd ini anda tidak cuma dapat memburning cd/dvd tetapi dapat anda pakai untuk convert, ubah video, design cover, backup, dan seterusnya.

ScreenShot:

Persyaratan:

- Windows® XP SP3 (32 bit), Windows Vista® SP2 or later (32/64 bit), Windows® 7 SP1 Home Premium, Professional or Ultimate (32/64 bit), Windows® 8 (32/64 bit)

- 2 GHz AMD or Intel® processor

- 1 GB RAM

- 5 GB hard drive space for a typical installation of all components (including templates, content and temporary disk space)

- Microsoft® DirectX® 9.0 compliant graphics card

- DVD disc drive for installation and playback

- CD, DVD, or Blu-ray Disc recordable or rewritable drive for burning

- Windows Media® Player 9 or higher

- Third party components such as Microsoft Windows® Installer 4.5, Microsoft .NET® 4, Microsoft® DirectX® or Adobe Flash are shipped with the product or automated download if not included in the package

- For some services an Internet connection is required

- Internet connection may be required to verify the serial number during usage of certain features. Internet connection charges are the user's responsibility